inheritance tax laws for wisconsin

Florida is a well. And whereas the 30 surtax was.

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Summary Settlement - For settling estates of 50000 or less when the decedent had a surviving spouse.

. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth. Wisconsin also has a sales tax between 5 to 6 and counties can leverage an additional 1. Wisconsin imposes an estate tax based on the federal.

Wisconsin Inheritance Tax Return. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. There are no Attorney.

How much can you inherit without paying taxes in 2020. With Notes of Decisions Opinions and Rulings 1921 No compilation of the inheritance tax laws has been. The occasion was the 1898 report of the.

Its a great reason to live in the state of Wisconsin and even spend your final days in the state of Wisconsin. The property tax rates are among some of the highest in the country at around 2. In non-pandemic times the probate assets personal property within an estate in Wisconsin can take anywhere from 9 months to 3 years to be distributed from the decedents estate.

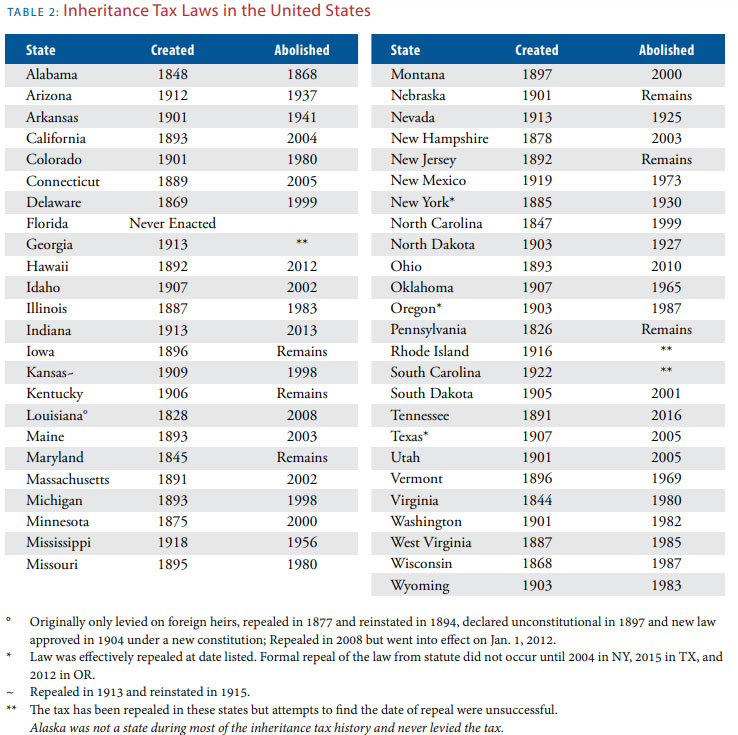

All inheritance are exempt in the State of Wisconsin. If death occurred prior to January 1 1992 contact the Department of. Policy Issues Influencing the Inheritance Tax Some of the major public policy issues related to the inheritance tax emerged soon after Sanderson.

There are NO Wisconsin Inheritance Tax. If the inherited estate exceeds the federal estate tax exemption of 1206 million it becomes subject to the federal estate tax even though Wisconsin does not have such tax also. And Whereas the 30 surtax was adopted in 1937 as an.

Does Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax works in the United. To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and Attorney Generals Opinions. Rule Tax Bulletin and.

Only the states inheritance tax laws but also the states gift tax laws4 Whereas the Wisconsin inheritance tax was adopted in 1903. Up to 5 cash back Excerpt from The Inheritance Tax Laws of Wisconsin. But currently Wisconsin has no inheritance tax.

The following table outlines Wisconsins Probate and Estate Tax Laws. If the total Estate asset property cash etc is over 5430000 it is subject to the.

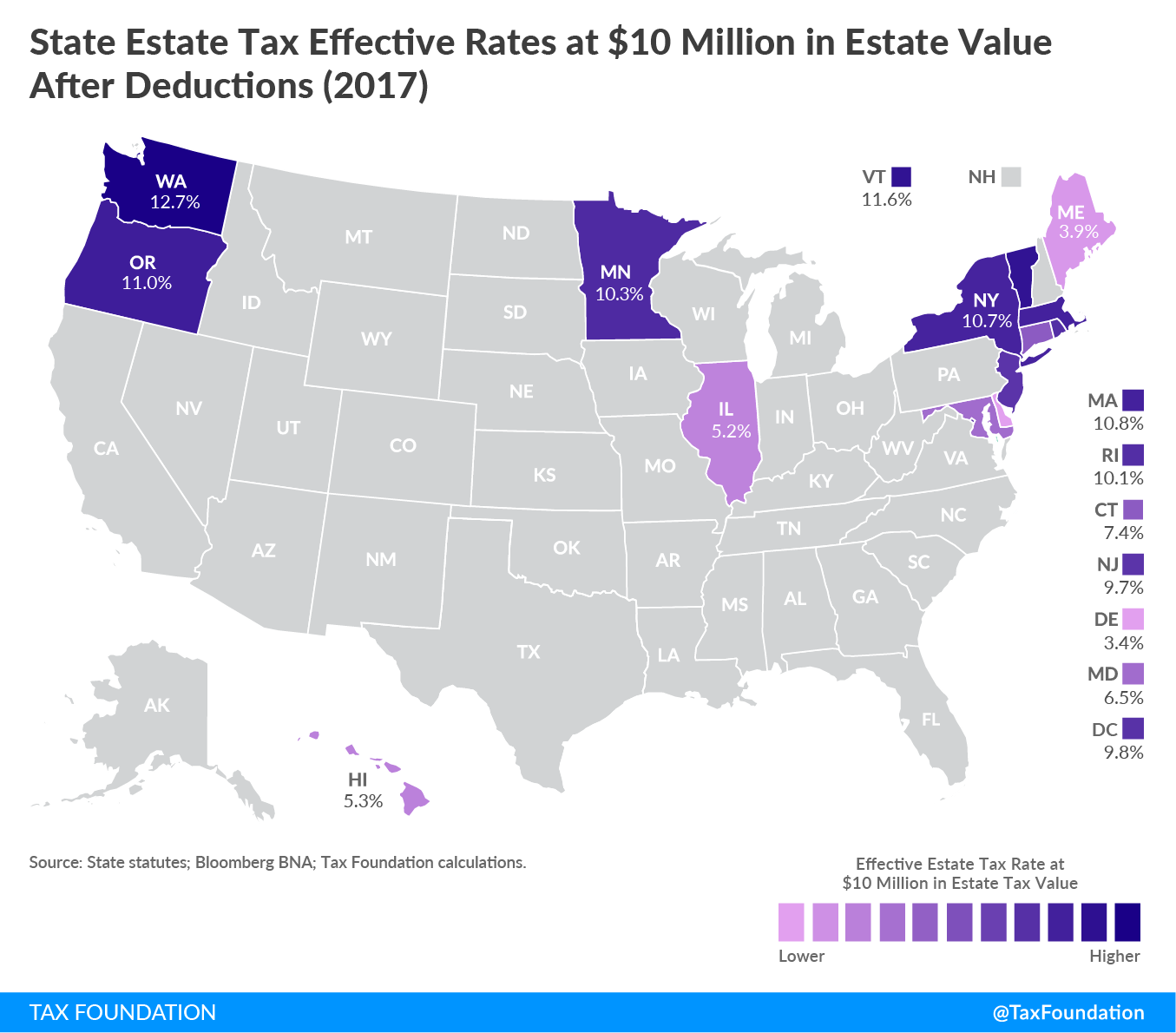

2019 State Estate Taxes State Inheritance Taxes

Estate And Inheritance Taxes Around The World Tax Foundation

State Estate And Inheritance Taxes Itep

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

10 Faqs About Wisconsin Last Will And Testaments

Estate Taxes In Wisconsin Heritage Law Office

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Calculate Inheritance Tax 12 Steps With Pictures

Wisconsin Estate Tax Everything You Need To Know Smartasset

How To Avoid Probate In Wisconsin It S Easier Than You Think

Estate And Inheritance Tax Coyle Financial

Amazon In Buy The Inheritance Tax Laws Of Wisconsin With Notes Of Decisions Opinions And Rulings 1921 Book Online At Low Prices In India The Inheritance Tax Laws Of Wisconsin With Notes

Transfer On Death Tax Implications Findlaw

Death And Taxes Nebraska S Inheritance Tax

Wisconsin Lawyer Time Runs Out On Wisconsin S Estate Tax

Estate Taxes In Wisconsin Heritage Law Office

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Comments

Post a Comment